🚀What is APX Finance?

Introduction

APX is the foremost decentralized exchange for crypto derivatives on BNB Chain. Offering both order book and on-chain perpetuals, APX empowers traders and stakers with unparalleled opportunities. Elevate trading with up to 1001x leverage, market-lowest slippage and competitive fees. Amplify returns with the highest stablecoin percentage LP yield among perpetual trading platforms.

V1: https://www.apollox.finance/en/futures/BTCUSDT

V2: https://www.apollox.finance/en/futures/v2/BTCUSD

V1 Order Book Perp (BNB Chain, Ethereum, Arbitrum, zkSync, Base, Manta)

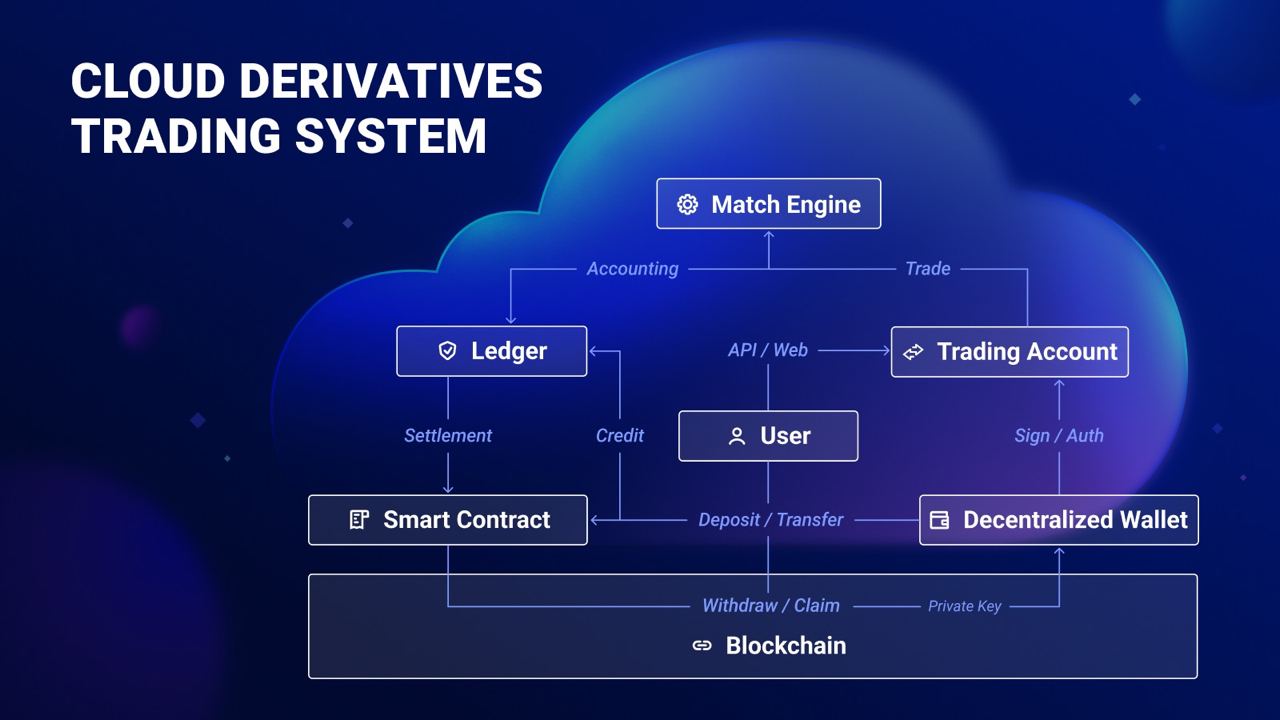

Adopting an "off-chain transaction matching + on-chain fund settlement and custody" model, APX V1 Order Book Perp achieves high transaction performance and fast response speeds while ensuring the safety of users’ funds. Trade over 95 markets with up to 250x leverage and enjoy competitive fees of 0.02% maker, 0.07% taker.

Users connect their decentralized wallets to the exchange before signing and verifying the connection through a Web3 interface. They can then transfer (ERC-20/BEP-20) tokens into the smart contract for fund custody and settlement. Once the off-chain ledger is recorded, users can use the funds to trade derivatives off-chain and the PnL will be accounted for in the ledger. After settlement, users can withdraw the funds by calling the smart contract (except for the margin occupied by open positions and pending orders).

For more, go to: Trading on V1

V2 On-Chain Perp (BNB Chain, Arbitrum)

Utilizing a fully on-chain liquidity model, APX V2 On-Chain Perp achieves more transparent trades with minimal slippage. All V2 trades are executed against the ALP pool, which provides liquidity for all trading pairs to maximize capital efficiency. V2 employs a dual oracle model consisting of Binance Oracle and Chainlink for the most accurate pricing.

Under Classic Mode, trade over 30 crypto and forex markets with up to 250x leverage and low fees while earning trading rewards. Trade with up to 1001x leverage, 0 slippage and 0 open fee specially under Degen Mode. For price prediction time-bound bets, trade in APX Dumb Mode with 60s/5min/10min expiry.

For more, go to: Trading on V2

Permissionless DEX Engine

The Permissionless DEX Engine is a SDK broker solution for any project looking to launch their own on-chain perp DEX. It currently supports BNB Chain and Arbitrum networks.

With a core offering of oracle-based perpetual futures (V2), Permissionless DEX Engine partners integrate APX's robust trading infrastructure to enjoy deep liquidity via the ALP pool and high leverage of up to 1001x. Partners also earn commission on trading fees among other benefits:

Customizable, branded trading interface

Native DEX experience

Liquidity sharing

New token use case

Dedicated client support

Platform Advantages

Dual Product Offering

Choose between V1 order book perp or V2 on-chain perp and trade the widest selection in the market.

High Leverage

Trade with up to 250x leverage for classic perps and up to 1001x leverage under Degen Mode.

Minimal Slippage

Enjoy tight spreads and deep liquidity for V1's order book. Reap the benefits of 0.01% slippage for V2 classic mode and 0 slippage for degen mode.

Reduced Fees

Benefit from low trading fees for more profits. Enjoy 0 cost trading with V2 trading rewards, especially on Arbitrum.

Earn Yield

Stake ALP and earn from platform fees and staking rewards. Stake $APX in DAO to get more $APX.

Last updated