💡V2 Fees & Slippage

Fees

Opening position fee

The fee for opening a cryptocurrency position is 0.08% and the fee for opening a FX position is 0.02% on BNB Chain. The fee for opening a cryptocurrency position is 0.05% on Arbitrum.

Opening Fee=Number of Contracts*Entry Price * Opening Fee Rate

For example, if a trader opens a 1 ETH/USD long position at 1,500 USD, then the opening fee =1* 1,500*0.08%=1.2 USD.

Closing position fee

The fee for closing a cryptocurrency position is 0.08% and the fee for closing a FX position is 0.02% on BNB Chain. The fee for closing a cryptocurrency position is 0.05% on Arbitrum.

Closing Fee=Number of Contracts*Close Price *Closing Fee Rate

For example, if a trader closes a 1 ETH/USD position at 1,600 USD, then the closing fee=1* 1,600*0.08%=1.28 USD

Execution fee

At the same time, in order to fulfill blockchain network costs and guarantee the normal functioning of the Keeper program — which helps to trigger and execute orders, users have to pay an execution fee.

The execution fee will only be charged when a position is opened. The execution fee is set at 0.5 USD (BNB Chain) / 0.2 USD (Arbitrum)/ 0.01 USD (opBNB)/ 0.3 USD (Base).

Funding rate

The funding rate is used to balance the difference in the long-short ratio of the platform, to protect ALP from excessive risk exposure during transactions, and to minimize the holding position risk of the pool.

The funding rate on APX Finance is calculated every block. When the market changes, the accumulated funding fee is automatically calculated. The funding fee will be reflected in the unrealized PnL of the position, directly affecting the user’s liquidation price.

Refer to Long_Funding Fee when user holds a long position;

Refer to Short_Funding Fee when user holds a short position,

The specific formula is as follows:

Funding Fee Per Block =(Number of Contracts * Mark Price) * Funding Rate Per Block

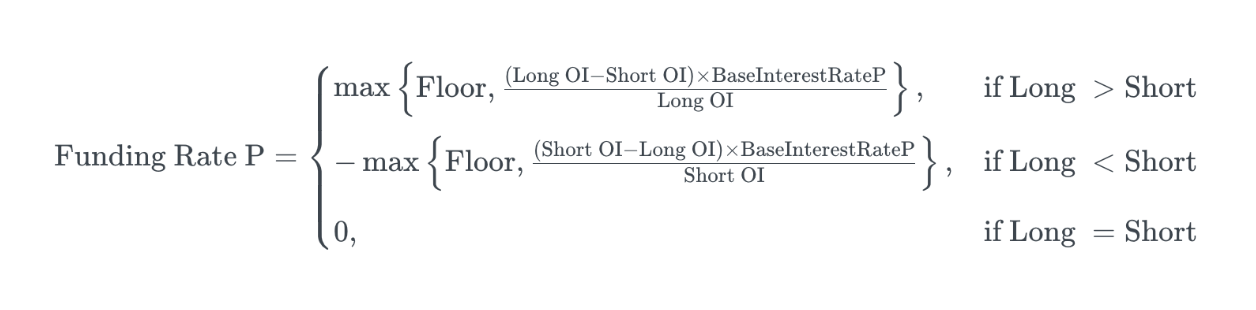

Funding Rate Per Block is calculated based on the gap between the long and short positions and current interest rate:

Long Funding Rate = Long Basic Funding Rate - Borrow Rate

Short Funding Rate = Short Basic Funding Rate - Borrow Rate

Long position> Short position,

Long Basic Funding Rate=-abs{funding rate p}

Short Basic Funding Rate=abs{funding rate p}

Long position< Short position,

Short Basic Funding Rate=abs{funding rate p}

Long Basic Funding Rate=-abs{funding rate p}

Borrow rate will be reviewed and updated regularly to ensure there is proper risk management. The borrowing fee is determined by the size of the user's position and the time of execution.

Base Interest Rate Per Block

Base Interest Rate Per Block = Base Interest Rate / (365*28800)

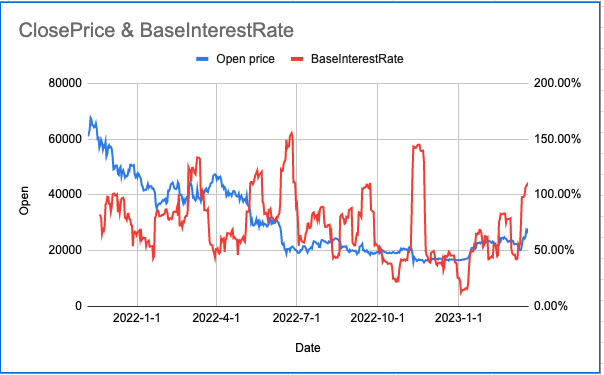

Based Interest Rate = k*HV

k is the adjustment factor, the platform may be adjusted when k=1.25

HV is the historical volatility, HV = 2Week Average Volatility *365

For more information, please refer to the History Volatility & Base Interest Rate below

Liquidation

Liquidation Price Distance = Entry Price * ( Initial Margin * Liquidation Lost Rate + CumFunding Fee) / Initial Margin / Leverage

Liquidation Price

Long: Entry Price - Liquidation Price Distance

Short : Entry Price + Liquidation Price Distance

Parameters:

Entry Price is the price at which the traders opens a position

Initial margin is the user’s initial collateral used as margin

Liquidation Lost Rate is the forced liquidation lost rate, and the default value is 90%

CumFunding Fee is the accumulated funding fee

Leverage is the user's selected leverage multiple

Example:

If the user opens a ETH/USD long position at 10x leverage, the entry price is 1,500, initial margin is 100, the funding fee is 2, the liquidation lost rate is 90%, then

Liquidation Price Distance = 1,500 * (100*90%+2) / 100 /10= 138

Liquidation Price = 1,500- 138 = 1,362

Slippage

Slippage on APX V2 will be adjusted based on the trading pair’s market depth determined by the Oracle. The platform will determine if the trading pair utilizes fixed slippage or dynamic slippage according to its liquidity from the oracle’s sources and this helps to prevent price manipulation at the same time. In general, slippage is positively correlated with open interest and newly opened positions, and is negatively correlated with the liquidity of the trading pair from the oracle's sources.

Fixed Slippage (for BTC, ETH and forex pairs)

When the user initiates an e.g. ETH/USD transaction, the price obtained by Binance Oracle is 1,500, and the slippage is 0.01%. Therefore, the user's entry price is 1,500.15, and the calculation formula is 1,500+(1500 * 0.01%)=1,500.15.

Since the liquidity of each trading pair in the oracle's source markets differs, the slippage of each trading pair is also different. In general, trading pairs with low liquidity have wider spreads. Users can check the specifics of each trading pair’s slippage on the trading page.

Dynamic Slippage (for all other V2 trading pairs)

The new dynamic slippage will be calculated based on ALP position. The dynamic slippage will be affected by current Symbol open interest and user's new position size.

Calculation formula:

Long_Dynamic Slippage (%)=(NewPostion+Symbol Long open interest) / 1%_DepthAbove

Short_Dynamic Slippage (%)=(NewPostion+Symbol Short open interest) / 1%_DepthBelow,

Whereby

Long open interest /Short open interest is the current value of the open positions of the trading pair

1%DepthAbove/ 1%DepthBelow is the current aggregated mainstream spot market depth +1%/-1% of a trading pair

For Degen Mode fees, see here.

Last updated