💡Fees for buying and selling ALP

To encourage more users to use different assets to buy ALP, APX Finance will adjust the fee for transacting ALP according to the target weight and current weight of the assets in the ALP liquidity pool. This will encourage the asset composition of the pool to be closer to the target weight. The formula is as follows:

Buying fee:

Basic Rate Parameter 1: FeeBasisPoints,USDT is currently set at 0.25%

Basic Rate Parameter 2: TaxBasisPoints,USDT is currently set at 0.05%

The current asset value: InitialValue=AssetValueInPool+AssetUnrealizedpnl_usd

The current asset value after minting: AfterMinValue=InitialValue+MinValue

Calculate the Asset value according to the target weight: TargetValue=(Total Value_usd+totalUnrealizedpnl_Usd)*Target weight,Total Value=sum(InitialValue)

The current Asset value and the target value (absolute value): InitialDiff=InitialValue-TargetValue

After Minting, the asset value and target mechanism (absolute value): AfterDiff=AfterMintValue-TargetValue

if AfterDiff<InitialDiffValue

MintFee=Max(FeeBasisPoints-TaxBasisPoints*InitialDiff/TargetValue,0)

if AfterDiff>=InitialDiff

MintFee=FeeBasisPoints+TaxBasisPoints*Min((InitialDiff+AfterDiff)/2,TargetValue)/TargetValue

Selling fee:

Basic Rate Parameter 1: FeeBasisPoints,USDT is currently set at 0.25%

Max Base Rate Parameter 2: TaxBasisPoints,USDT is currently set at 0.05%

The current asset value: InitialValue=AssetValueInPool+AssetUnreliazedpnl_usd

The current asset value after Burn: AfterMaxValue=InitialValue-MinValue

Calculating the Asset value according to the target weight: TargetValue=Total Value*Target weight

The current asset value and target value (absolute value): InitialDiff=InitialValue-TargetValue

After Burn, the asset value and target mechanism (absolute value): AfterMaxDiff=AfterBurnValue-TargetValue

if AfterDiff<InitialDiffValue

BurnFee=Max(FeeBasisPoints-MTaxBasisPoints*InitialDiff/TargetValue,0)

if AfterDiff>=InitialDiff

BurnFee=FeeBasisPoints+TaxBasisPoints*Min((InitialDiff+AfterDiff)/2,TargetValue)/TargetValue

For example:

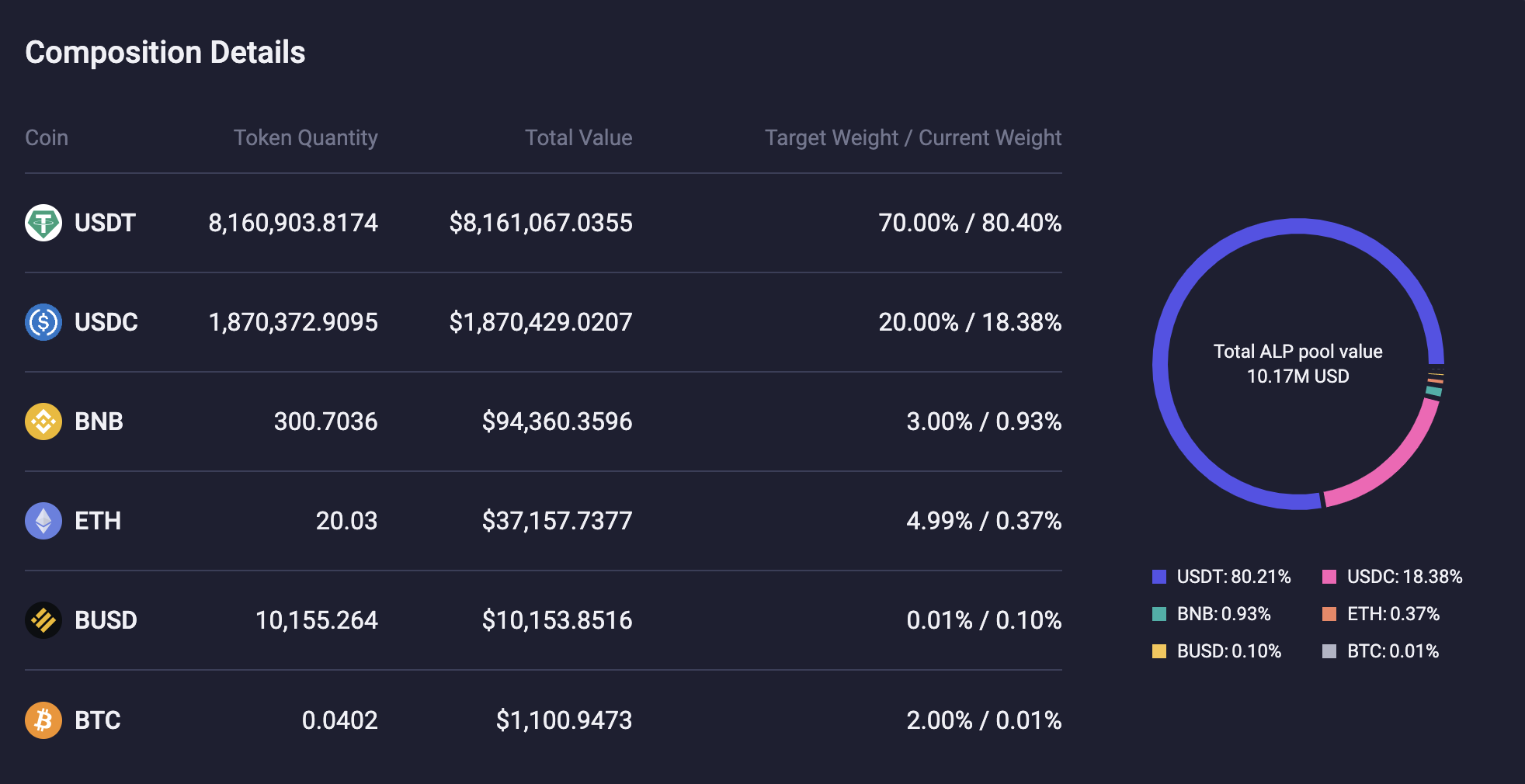

If the value of the ALP pool is $10,000,000, the unrealized PnL is $+10,000, the value of BTC in the liquidity pool is $1,000;

The BTC target weight is 2%, and the current weight is 0.01%. The base rate parameter 1 of BTC is 0.25%, and the base rate parameter 2 is 0.45%.

According to the calculation, the rate of buying ALP with 1 BTC at this time is 0% = 0 BTC. The transaction fee for selling ALP to get 1 BTC is 0.7% = 0.007BTC.

Users can click here to view the composition of the ALP liquidity pool, the tokens’ quantities and values, target weights and current weights, as well as other information.

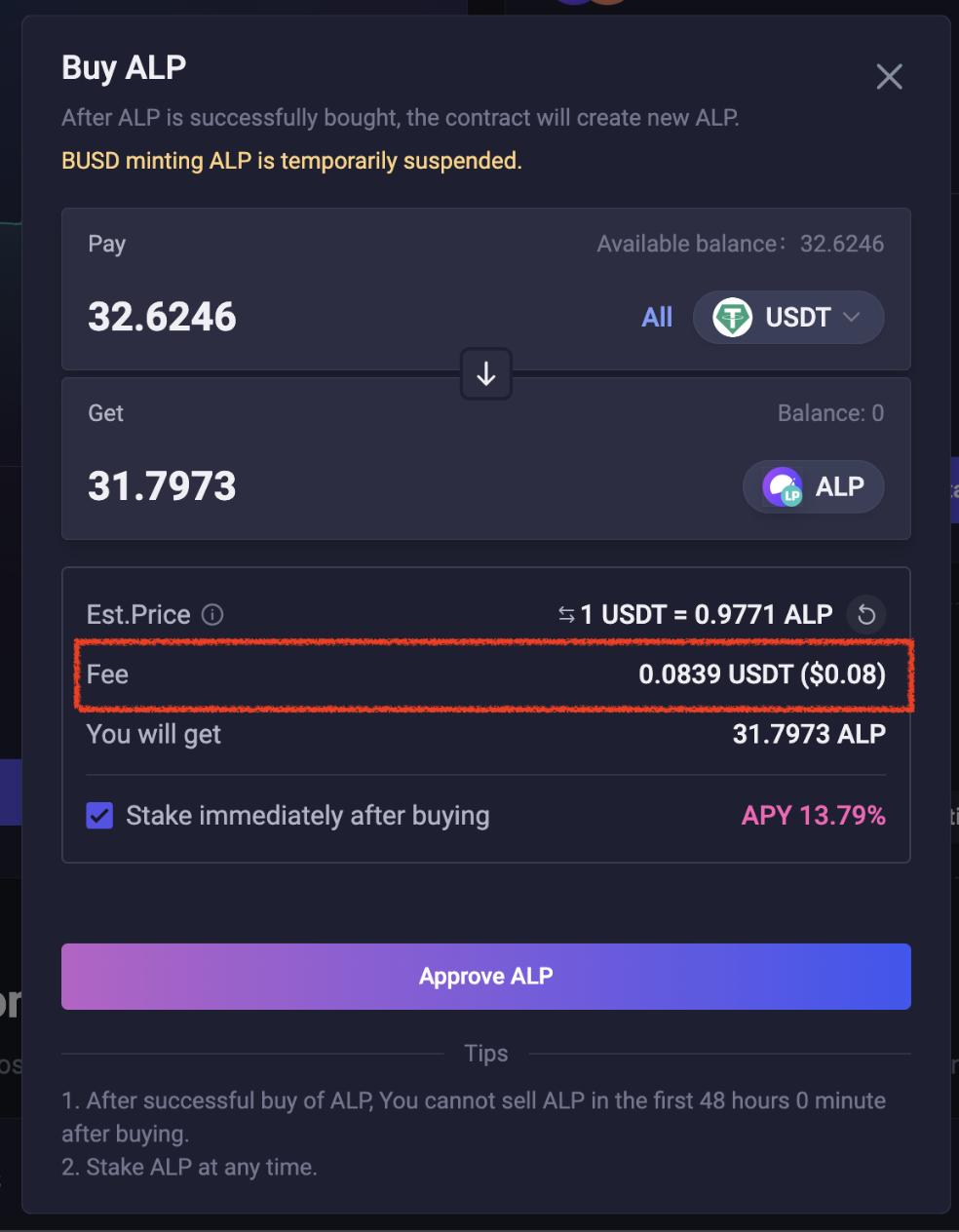

After the user selects the asset and quantity and clicks [Buy ALP] or [Sell ALP], the page will display the fees for this transaction as per the image below:

Last updated