❓Auto-Deleveraging (ADL)

Auto-deleveraging (ADL) is a risk management mechanism that occurs when the market is extremely volatile. ADL occurs as the final step after all other options have been exhausted.

APX strives to keep ADL to the bare minimum so as to provide users with the best trading experience. However, it is useful for traders to understand how ADL works to avoid it in extreme market conditions.

How does ADL work?

When a position is taken over by the liquidation engine i.e. liquidated, if the position is closed at a worse price than the bankruptcy price, the extra cost of this liquidation process will be covered by APX liquidation system. If the liquidation cannot be filled by the time the mark price reaches the bankruptcy price, the ADL system automatically deleverages the opposing trader’s position, which is calculated based on profit and leverage priority.

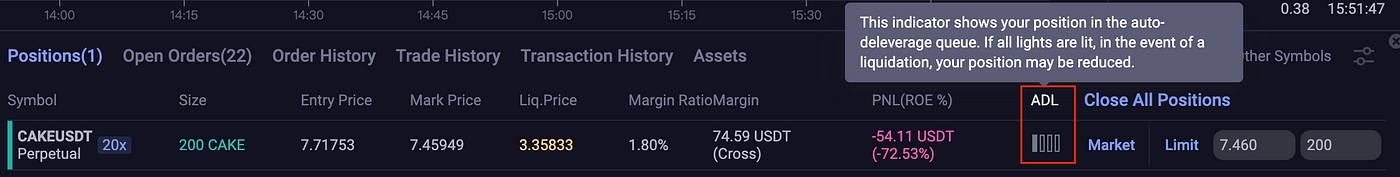

As a trader, you may evaluate whether your position is at risk of counterparty-liquidation based on an indicator of your priority in the queue — the LeveragePnLQuantile term. When all four bars are lit, it indicates that your position faces a higher ADL risk. As the number of lit bars decrease, so does the ADL risk.

When ADL occurs, a notification email is immediately sent to the affected user.

Calculation for ADL priority ranking

Pnl Percent=max(0,Unrealized Profit)/max(1,Wallet Balance)

If (Wallet Balance+Unrealized Profit)≤0, then Margin Ratio=0

If (Wallet Balance+Unrealized Profit)>0, then Margin Ratio=Maintenance Margin/(Wallet Balance+Unrealized Profit)

Leverage Pnl=Pnl Percent×Margin Ratio Leverage Pnl=Pnl Percent×Margin Ratio

Leverage Pnl Quantile=rank(user.Leverage Pnl)/Total User Count

Note:

Bankruptcy price may be out of the contract’s market price range.

Users with more lights turned up on the indicator and higher ranking are more likely to deleverage.

To avoid ADL, users can reduce the leverage of their position; or first close a position and then open another.

When there is an ADL, a notification email is immediately sent to the affected user. Users will be free to re-enter at any time.

Last updated