❓How to Calculate the Cost of Opening a USDⓈ-M Perpetual Futures Contract Position

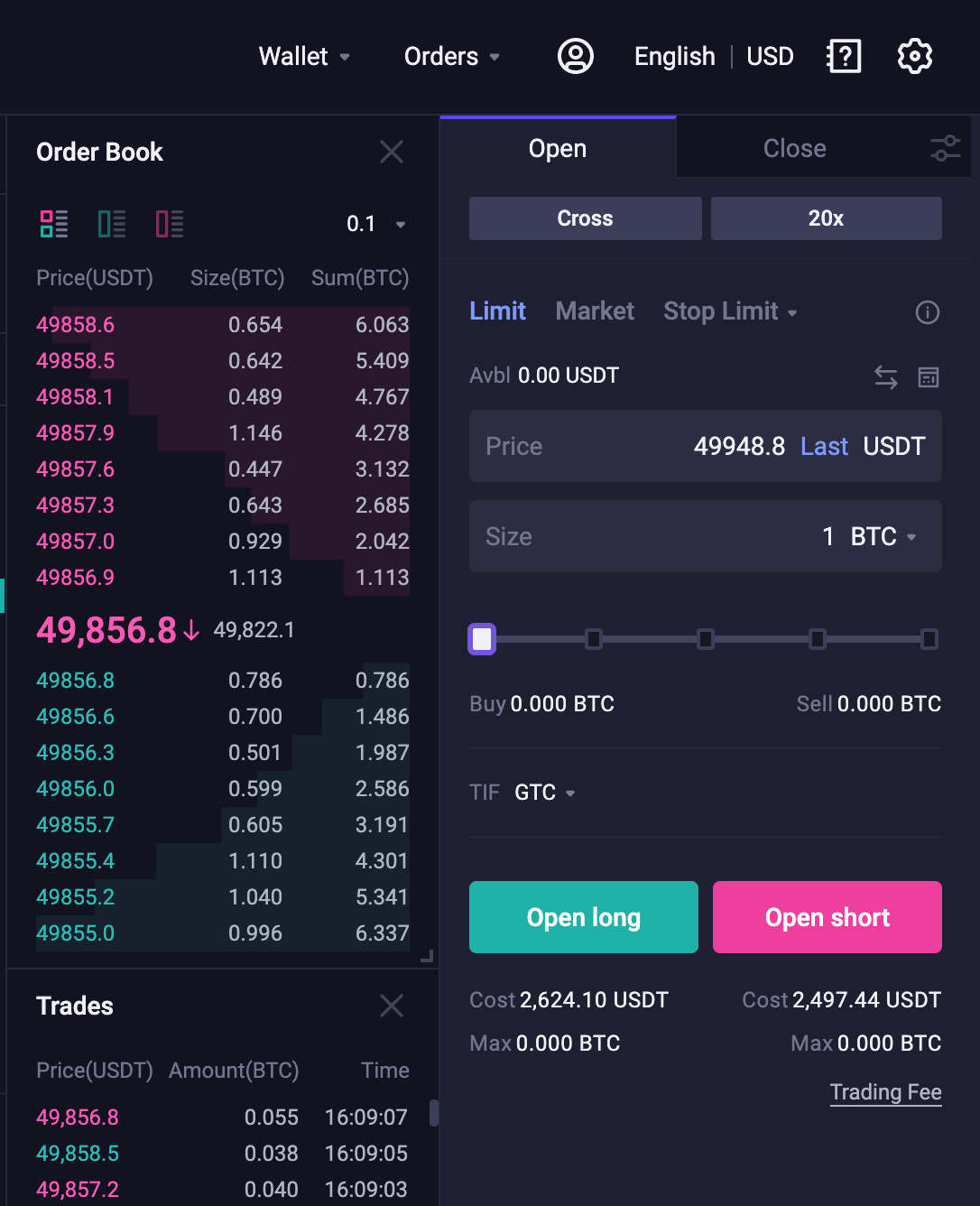

Calculating the cost of opening a Limit Order:

1. Calculate the Initial Margin

Initial Margin

= Notional Value / Leverage Multiplier

=(49948.8*1 BTC)/20x

=2497.44

2. Calculate Open Loss

Open Loss = Number of Contracts × Absolute Value {min [0, Order Direction × (Mark Price — Order Price)]}

Direction of order: 1 for long order;-1 for short order

Open Loss of long order

= Number of Contract * Absolute Value {min[0, Direction of order * (Mark price — Order Price)]}

= 1 * Absolute Value {min[0, 1 * (49822.1- 49948.8)]}

= 1 * Absolute Value {min[0, (-126.7)]}

= 1 * 126.7

= 126.7

Open loss occurs when you place a long order.

Open Loss of Short Order

= Number of Contract * Absolute Value {min[0, Direction of order * (Mark Price — Order Price)]}

= 1 * Absolute Value {min[0, -1 * (49822.1- 49948.8)]}

= 1 * Absolute Value {min[0, 126.7]}

= 1 * 0

= 0

Open loss does not occur when you place a Short order.

3. Calculate the cost of Opening a Position

Since there is no Open Loss when you place a Short order, the cost of opening a Short order is equal to the Initial Margin.

Cost of opening a Long Order

=2497.44 + 126.7

=2624.14

Cost of opening a Short Order =2497.44 + 0 =2497.44

Since an Open Loss occurs when you place a Long order, it costs more to place a Long order. In addition to the Initial Margin, you must also take into account the Open Loss.

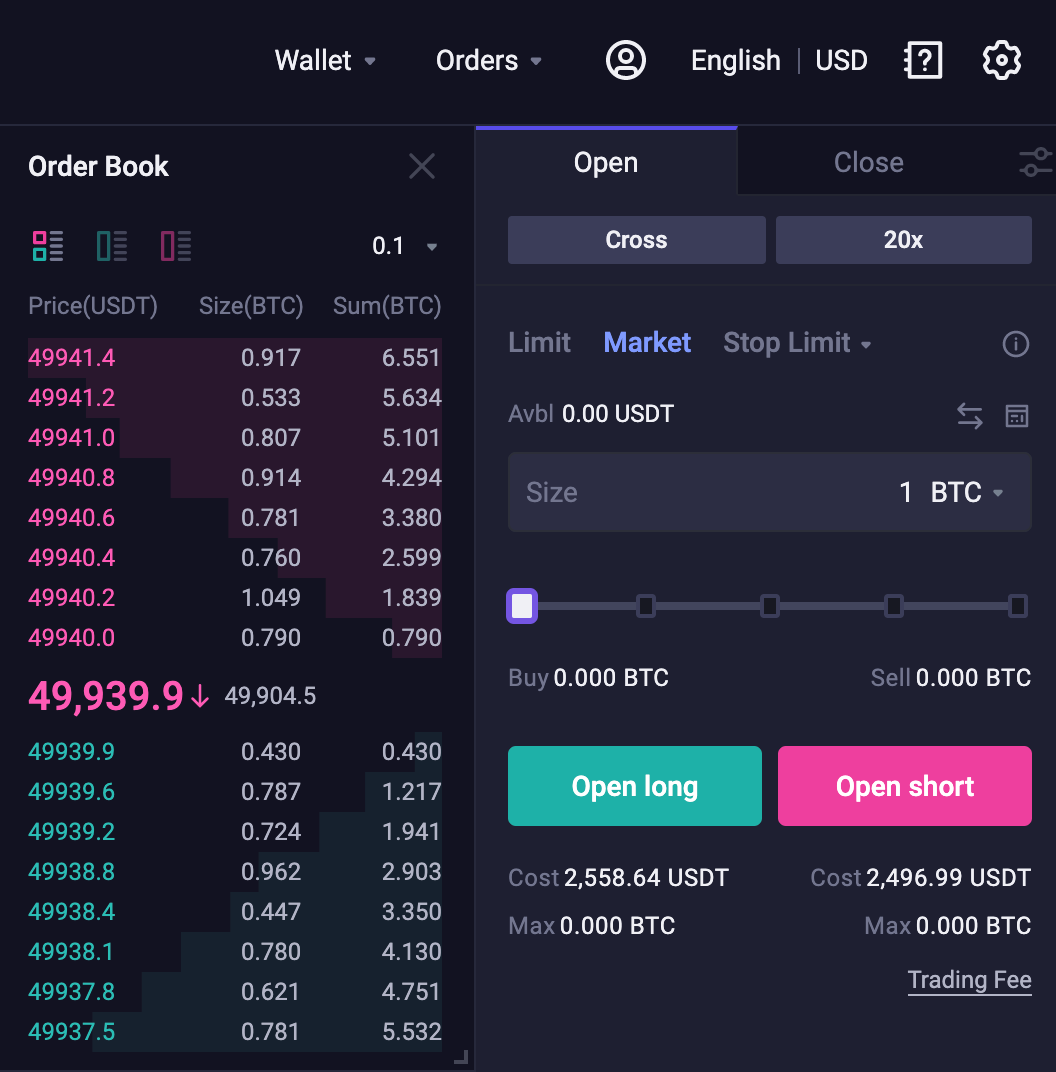

Calculating the cost of opening a Market Order:

1. Calculate Estimated Entry Price

Long order estimated entry price = ask[0] * (1 + 0.05%); Short order estimated entry price = max(bid[0], mark price)

Estimated entry price of long order

=ask[0]*(1 + 0.05%)

=49939.9*(1 + 0.05%)

=49964.87

*[0]:Level 1 price

Assuming price of short order

= max(bid[0], mark price)

= max (49940, 49904.5)

= 49940

*[0]:Level 1 price

2. Calculate the Initial Margin

Initial Margin = Notional Value / Leverage Multiplier

Initial margin for long order

= Estimated entry price of long order * Number of Contracts / Leverage Multiplier

=49964.87 * 1 /20

=2498.2435

Initial margin for short order

= Estimated entry price of short order * Number of Contracts / Leverage Multiplier

=49940 * 1/20

=2497

3. Calculate the Open Loss

Open Loss = Number of Contract * Absolute Value {min[0, direction of order * (mark price — order price)]}

Direction of order: 1 for long order;-1 for short order

Open loss for long order

= Number of Contract * Absolute Value {min[0, direction of order * (mark price — order price)]}

= 1 * Absolute Value {min[0, 1 * (49904.5–49964.87)]}

= 1 * Absolute Value {min[0, -60.37]}

= 1 * 60.37

= 60.37

An Open Loss occurs when you place a Long order.

Open loss for short order

= Number of Contract * Absolute Value {min[0, direction of order * (mark price — order price)]}

= 1 * Absolute Value {min[0, -1 * (49904.5–49940)]}

= 1 * Absolute Value {min[0, 35.5]}

= 1 * 0

= 0

An Open Loss does not occur when you place a Short order.

4. Calculating the cost of Opening a Position

Since Open Loss occurs when you place a Long order, it costs more to place a Long order. In addition to the Initial Margin, you must also take into account the Open Loss.

Cost of opening a Long Order

=2498.2435+60.37

=2558.6135

Cost of opening a Short Order

=2497+0

=2497

Since there is no Open Loss when you place a short order, the cost of opening a Short order is equal to the Initial Margin.

Last updated