👾Futures Grid Trading Auto Parameters Guide

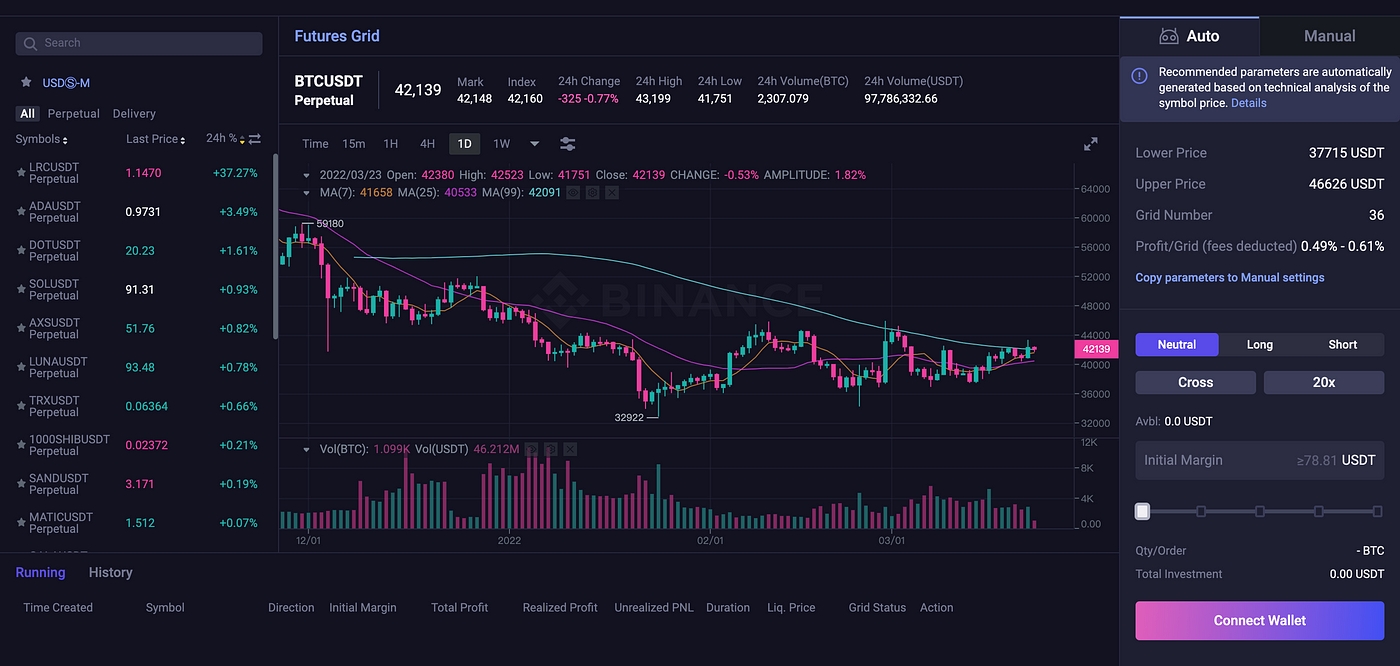

1.Navigate to the right sidebar of the Futures Grid trading interface. On the [Auto] tab, verify the recommended parameters and set up your [Initial Margin].

2. Once you have decided the amount of margin that you want to allocate to your grid trading strategy, click [Create], and confirm your grid order so the system automatically places buy or sell orders at the preset prices.

Please be aware that the auto parameters function will not work when there is not enough trading history on a given asset. Under such circumstances, you will have to set the parameters manually or click [Copy parameters to Manual settings] to modify the lower price, upper price, and grid number.

How are auto parameters calculated?

Upper & Lower Price

Upper Band = MA + bbm * Standard Deviation

Lower Band = MA — bbm * Standard Deviation

Grid Number

Grid Number = (grid_upper_limit — grid_lower_limit)/ATR

*Average True Range (ATR) for the past pre-defined hours of the selected symbol

Risk Reminder: Grid trading as a strategic trading tool should not be regarded as financial or investment advice from APX. If the grid setting is unreasonable, you will not be able to get the relevant grid revenue when the market enters the one-sided market and is not inside the grid interval you set. You can adjust the grid strategy according to the current market conditions. Grid trading is used at your discretion and at your own risk. APX will not be liable to you for any loss that might arise from your use of the feature. It is recommended that users should read and fully understand the Grid Trading Tutorial and make risk control and rational trading within your financial ability.

Last updated