❓Funding Rate

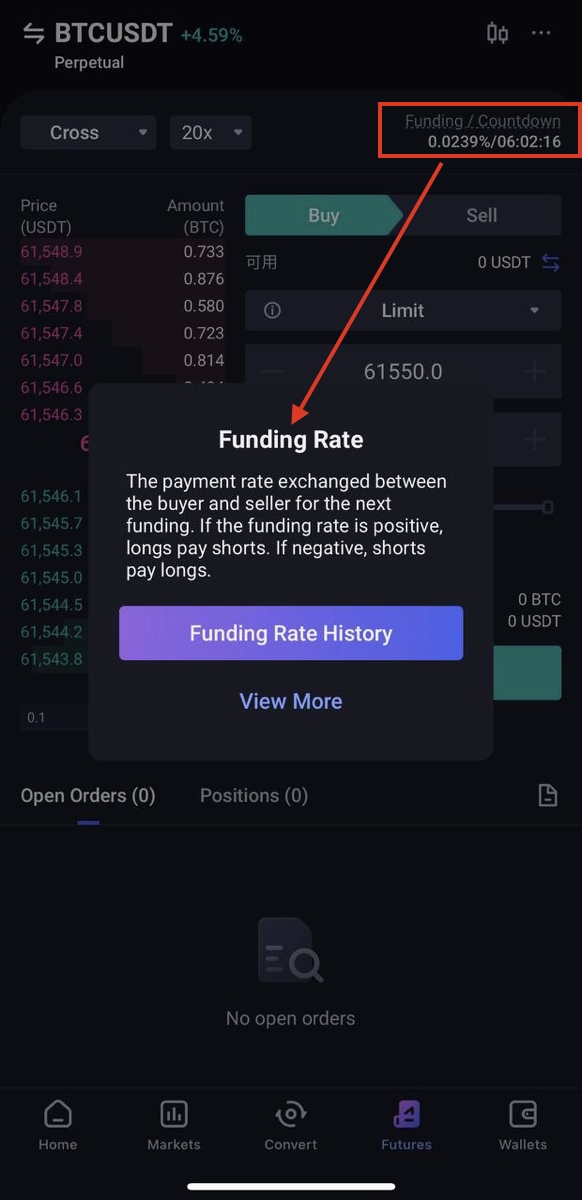

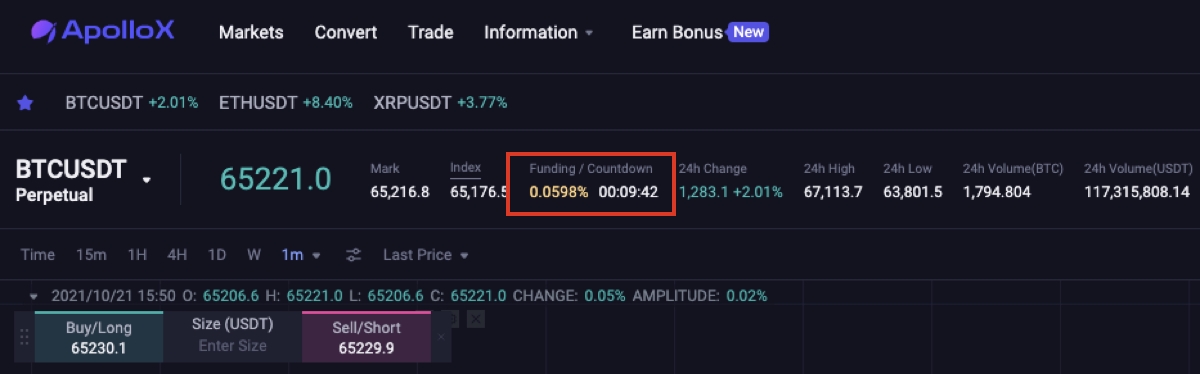

Below, you can see the Funding Rate and the countdown timer to the next Funding Rate on APX:

(Website)

(App)

1. The role of the Funding Rate

The key role of the Funding Rate is to narrow the price difference between the perpetual futures market and the corresponding spot market (price regression).

2. Why is the Funding Rate so important?

Traditional futures contracts are settled on a monthly or quarterly basis, depending on contract specifications. At settlement, the contract price converges with the spot price, and all open positions expire. Perpetual futures contracts are widely used by crypto derivatives exchanges and are designed to be similar to traditional futures contracts. However, perpetual futures contracts have one key difference.

Unlike traditional futures contracts, perpetual futures allow traders to hold contracts in perpetuity, without expiration dates or the need to track unused delivery months. For example, a trader can keep a short position open indefinitely until the position is closed. In this way, trading perpetual futures is very similar to trading spot market pairs. However, perpetual futures do not use a traditional method of settlement. Because of this, crypto exchanges have created a mechanism to ensure that perpetual futures contract prices match the index price. This mechanism is called the Funding Rate.

3. What is the Funding Rate?

A Funding Rate is a periodic payment made to long or short traders based on the price difference between the market price of the perpetual contract and the spot price. When the market is bullish, the Funding Rate is positive and long traders pay a funding fee to traders who are short. Conversely, when the market is bearish, the funding rate is negative and short traders pay the funding fee to long traders.

APX does not charge any fees for funding rate transfers, as funds are transferred directly between users. Funding fees on APX are taken every 8 hours at 00:00 UTC, 08:00 UTC, and 16:00 UTC. Traders are only liable for funding payments in either direction if they have open positions at the predetermined funding times. Traders who do not have an open position will not pay or receive any funding.

Note: There is a 15-second deviation between the actual time and the time the funding fee is taken. For example, if you open a position at 16:00:05 UTC, you may still be charged a funding fee. Therefore, it is important that you pay attention to the exact time you open a position.

4. How is the Funding Amount calculated?

Funding Amount = Notional Value of Positions × Funding Rate

Notional Value of Position = Mark Price × Number of Contracts

5. How is the Funding Rate determined?

There are two components to the Funding Rate: the Interest Rate and the Premium. The Premium explains why the price of a perpetual contract converges with the price trend of the underlying asset. APX uses a fixed interest rate within the funding rate, with the assumption that the interest earned by holding cash is higher than the interest earned by holding the BTC equivalent. By default, the interest rate is set at 0.03% per day (0.01% per funding settlement interval) and may change based on market factors, such as the Federal Funds Rate.

During periods of high volatility, there may be a significant difference between the price of the perpetual contract and the Mark Price. At such times, the Premium Index will be used to enforce price convergence between the Futures market price and the Spot price.

The Premium Index is calculated separately for each contract. The formulas are as follows:

Premium Index (P) = [Max (0, Impact Bid Price — Price Index) — Max (0, Price Index — Impact Ask Price )] / Price Index

Impact Bid Price = Average fill price to execute the Impact Margin Notional on the Bid Price

Impact Ask Price = Average fill price to execute the Impact Margin Notional on the Ask Price

Price Index: A comprehensive index based on a basket of prices from the major spot exchanges, weighted by their relative volume.

Impact Margin Notional (IMN) for USDT Perpetual Futures Contracts: The notional available to trade with 200 USDT worth of margin (price quoted in USDT); IMN = 200 USDT / Initial Margin Rate at maximum leverage.

Aggregated Impact Margin Notional: When the number of pending orders in the market is insufficient, APX will will introduce the Aggregated Impact Margin Notional. The calculation of the Impact Margin Notional is done by aggregating order books from multi platforms with the formula as shown: Aggregated Impact Margin Notional= IMN by aggregating order books from multi platforms / Initial Margin Rate at maximum leverage.

Click here for more on Leverage and Margin for USDⓈ-M Perpetual Futures.

6. Calculate the Impact Bid/Ask Price

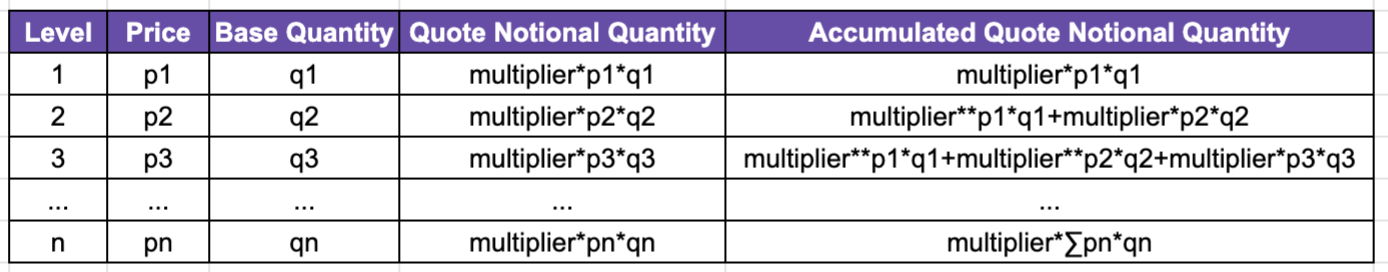

Assume that the bid-side of the order book is as follows:

If the cumulative commission amount quoted at Level x is greater than the IMN: Contract multiplier × ∑px × qx > IMN, and if the cumulative commission quoted at Level x-1 is less than the IMN: Contract multiplier × ∑px-1 × qx-1 < IMN, then the Impact Bid Price at Level x is included in the calculation.

Formula:

Impact Bid Price = IMN / (IMN — Contract Multiplier × ∑px-1 × qx-1) / px + Contract Multiplier × ∑qx-1)

Last updated